2025 Tax Brackets Head Of Household Married Jointly. Here’s how that works for a single person with taxable income of $58,000 per year: The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

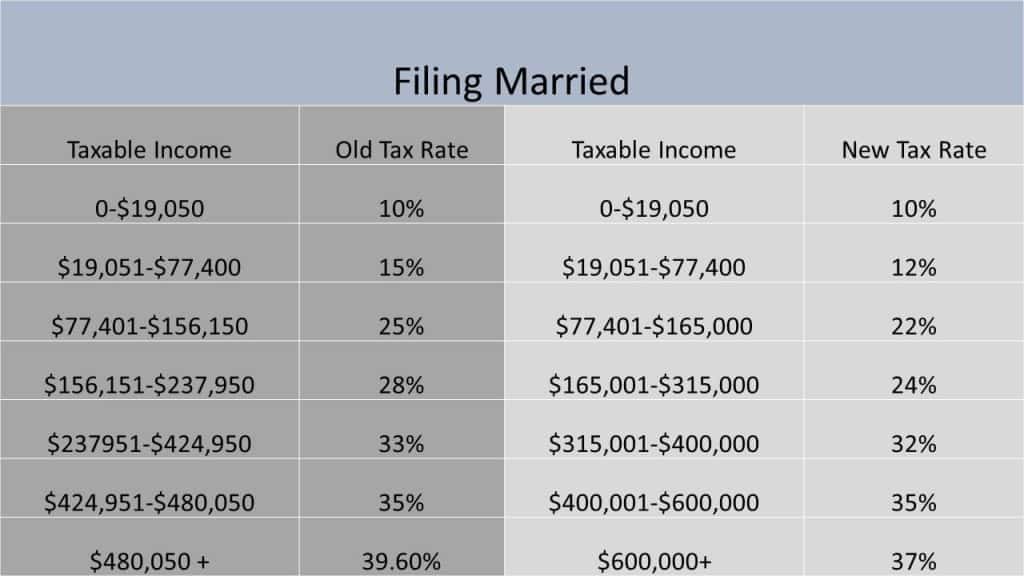

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. Your bracket depends on your taxable income and filing status.

Married Filed Jointly Tax Brackets 2025 Meggy Silvana, Let’s say you’re married filing jointly with $110,000 in taxable income.

2025 Tax Rates Married Filing Jointly And Head Of Household Jojo Roslyn, For example, a married couple filing jointly will now be taxed at the top rate of 37% on income over $751,600.

Tax Brackets 2025 Calculator Married Jointly Lian Sheena, Let’s say you’re married filing jointly with $110,000 in taxable income.

New Jersey 2025 Tax Brackets Married Jointly Bobbi Chrissy, See current federal tax brackets and rates based on your.

Tax Brackets 2025 2025 Married Jointly Eloise Jemimah, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets Married Filing Jointly Single Judy Sabine, Your bracket depends on your taxable income and filing status.

2025 Married Filing Jointly Tax Tables Calculator Eudora Modestia, In 2025 and 2025, the income tax rates for each of the seven brackets are the same:

Tax Brackets 2025 Head Of Household Married Jointly Tanya Florinda, Here’s how that works for a single person with taxable income of $58,000 per year:

Federal Tax Brackets 2025 Head Of Household Jana Rivkah, Remember, these aren't the amounts you file for your tax return, but rather the amount of tax you're going to pay starting january 1,.

2025 Federal Tax Rates Married Filing Jointly Carol Aundrea, Your bracket depends on your taxable income and filing status.